The Transition, away from the ever increasing use of fossil power, towards a low carbon world, calls for innovative ways to generate clean energy and to use less energy. The EU plays it’s part, in conjunction with the private sector and governments, to provide help and incentives for solutions to replace dirty energy with clean energy and to reduce the use of energy by smart means. All this at a time of a growing population and demands from ‘undeveloped’ populations for improved standards of living.

EU Innovation Initiatives

The EU has a Commissioner for Research, Science and Innovation, Carlos Moedas, who stated his three goals:

- Open innovation by bringing a variety of actors together

- Open science by promoting synergies and the sharing of research results

- Openness to the world by being a prime example of a truly global collaboration.

He stated this when the EU joined Mission Innovation, formed by the governments who will double their spend on clean energy research and investment. Mission Innovation brings together ‘actors’ such as governments and entrepreneurs ie the “leading investors with experience in driving innovation from the lab to the marketplace”.

Private Capital

source: Wired 30th Nov 2015

Bill Gates, Mark Zuckerberg, Richard Branson, Jeff Bezos to name just a few of the billionaires who are part of the Breakthrough Energy Coalition. “Success requires a partnership of increased government research, with a transparent and workable structure to objectively evaluate those projects, and committed private-sector investors willing to support the innovative ideas that come out of the public research pipeline.”

To ‘promote synergies and the sharing of research’ the EU has an Institute of Innovation and Technology working together with European bodies enabling funding.

Innovation Activities

The European Institute of Innovation and Technology (EIT)

The European Institute of Innovation and Technology (EIT) “brings together leading universities, research labs and companies…” EIT:

· creates Knowledge and Innovation Communities (KICs)

· develops innovative products and services

· starts new companies

· trains a new generation of entrepreneurs

Truely Global Collaboration

The European Research Area is “a unified area open to the world, in which scientific knowledge, technology and researchers circulate freely.”

Clean-tech business idea competition

One offshoot is “ClimateLaunchpad, the world’s biggest clean-tech business idea competition with currently a presence in 28+ countries. “We help Europe’s most promising start-ups take their sustainability innovation to the next level.”

EU Financing Initiatives

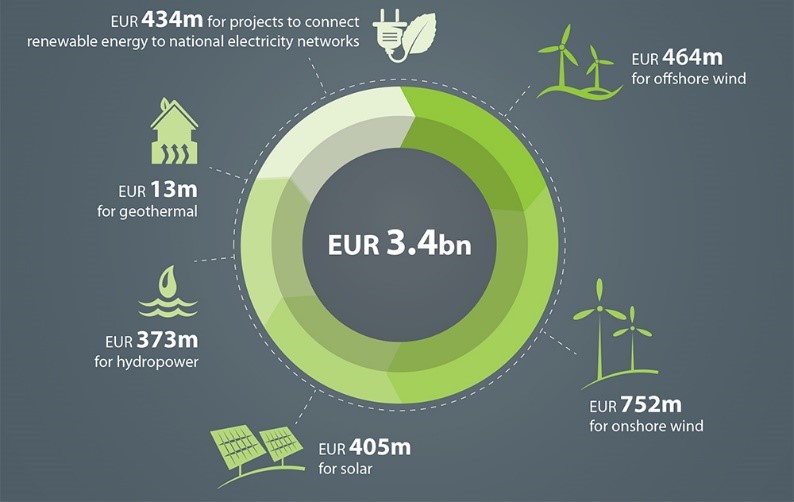

European Investment Bank (EIB)

“The EIB is the European Union’s bank. We are the only bank owned by and representing the interests of the European Union Member States.”….. “As the largest multilateral borrower and lender by volume, we provide finance and expertise for sound and sustainable investment projects which contribute to furthering EU policy objectives”We work closely with other EU institutions to implement EU policy.”…… …..”we commit at least 25% of our lending portfolio to low-carbon and climate-resilient growth.”…. “We finance large projects with direct Project loans whereas we support smaller projects indirectly, through credit lines to local banks or other intermediaries.”

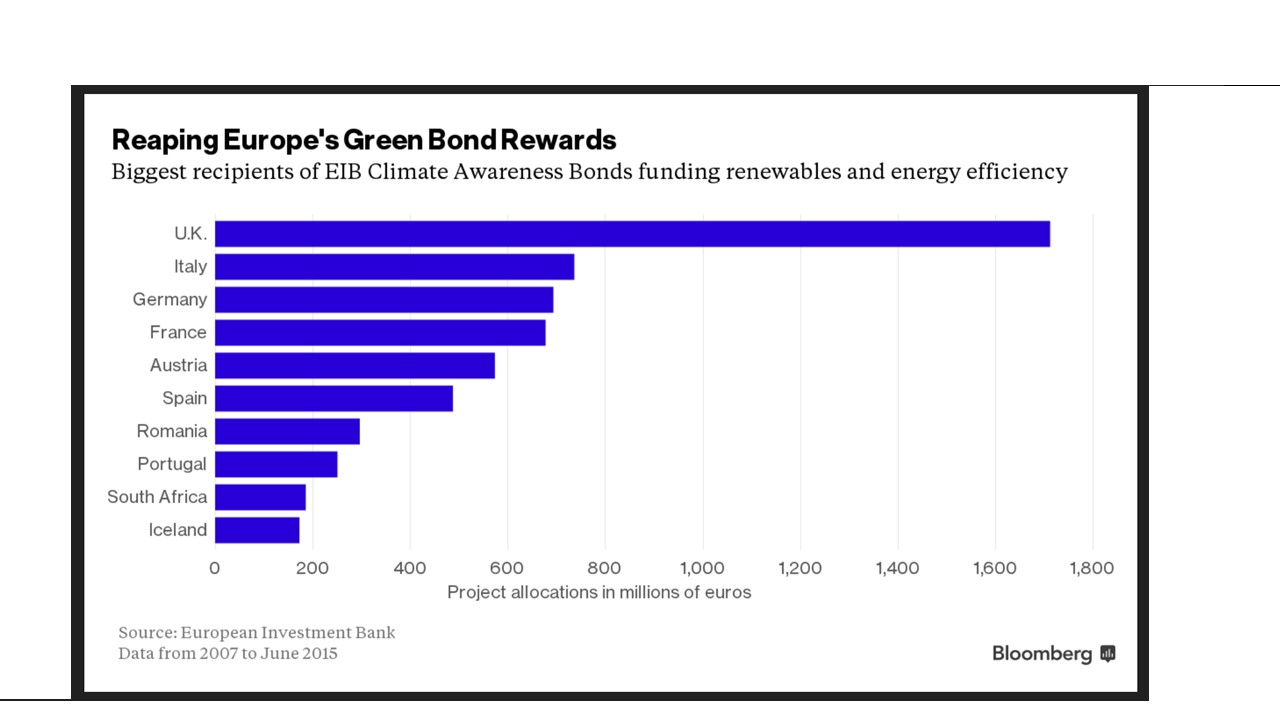

The EIB raises its funds through the issue of Climate Awareness Bonds. For instance, in Aug 2015 it issues a €600m bond, with an annual coupon of 0.5%, maturing in Nov 2023.

Emissions Trading Income to Renewable Energy Systems (RES) and Carbon Capture and Storage (CCS)

NER300 New Entrants’ Reserve (NER) is funded from the sale of 300 million emission allowances set up for the third phase of the EU emissions trading system (ETS) that covers aviation, power and industry. It is used to establish a demonstration programme comprising the best possible CCS [carbon capture & storage] and RES projects and involving all Member States. The programme intends to support a wide range of CCS technologies (pre-combustion, post-combustion, oxyfuel, and industrial applications) and RES technologies (bioenergy, concentrated solar power, photovoltaics, geothermal, wind, ocean, hydropower, and smart grids).

For the UK the NER300 fund has disbursed at least €300m for the White Rose Carbon Capture and Storage (CCS) project. And €18.4m for the Ocean Kyle Rhea tidal turbines and €20.7m for the Ocean Sound of Islay tidal turbines.

EU Climate Action Spend from EU Budget

Supporting Climate Action Through the EU budget includes: “To respond to challenges and investment needs related to climate change, the EU has agreed that at least 20% of its budget for 2014-2020 – as much as €180 billion − should be spent on climate change-related action.” The €180bn was broken down in Dec 2013 at An EU Budget for low carbon growth calling the budget “a major step forward in transforming Europe into a clean and competitive low carbon economy and helping developing countries adapt to the impacts of climate change.”

EU Grants

Horizon 2020 funds EU Research and innovation, “with nearly €80bn of funding available over 7 years (2014 to 2020) – in addition to the private investment that this money will attract.” EU Horizon 2020 “funds support the research, demonstration and market up-take of energy efficient technologies. Funds are available to support energy efficient buildings, industry, heating and cooling, SMEs and energy-related products and services, as well as for improving the attractiveness of energy efficiency investments.” The EU Horizon initiative is one of the EU’s Funding Energy Efficiency programme.

Horizon 2020 also includes a budget of €3.7 billion for the Societal Challenge 2 (SC2) on

“Food security, sustainable agriculture and forestry, marine, maritime and inland water research and the bioeconomy” for 2014-2020.

European Local ENergy Assistance (ELENA) : Managed by the European Investment Bank, this provides grants to help local and regional authorities develop and launch large-scale sustainable energy investments in the form of Project Development Assistance (PDA). ELENA covers up to 90% of the technical support costs.

PDA: This programme helps public and private project promoters develop sustainable energy investment projects ranging from €6 million to €50 million. A new call is open until 15 September 2016.

“Proposals can be submitted by at least 1 public or private entity and cover a wide range of sectors, e.g.:

- Existing public and private buildings;

- Street lighting;

- Energy efficient retrofitting of existing district heating/cooling schemes;

- Energy efficiency in urban transport; and

- Energy efficiency in industry and services.”

Also more than €200 million is earmarked to support European Institute of Innovation and Technology activities, subject to a mid-term review. ….. Research and demonstration activities within this area will focus on buildings, industry, heating and cooling, SMEs and energy-related products and services, integration of ICT and cooperation with the telecom sector.

Make Chernobyl safe – according to the RT in April 2016, the EU committed a further €70m in April 2016 to make the Chernobyl exclusion zone safe.

EU loans etc

The EIB manages Structured finance support for priority projects with a higher risk profile than we normally accept. Funds available up to €3.75bn.

Private Finance for Energy Efficiency (PF4EE) €480m will be available in long term financing to “to increase the availability of debt financing to eligible energy efficiency investments.” one PF4EE operation will be in each country, when agreed. (eg The Czech Republic, Spain and France)

Loans to UK

In 2015, the European Investment Bank lent €7.77 bn to UK projects

Bloomberg Feb 2016: Brexit may lose the UK billions in funding for climate renewables.

For instance, TfL borrowed €1.4 bn(£1 bn) “to finance the upgrading of existing lines and stations on the London Underground, as well as the construction of a network of cycle paths in the capital.”

Energy efficiency projects throughout the UK, included €510 million for c. 7 million smart meters for British Gas customers throughout Great Britain.

EU mixed Loans/Grants

Natural Capital Financing Facility (NCFF) “will promote the conservation, restoration, management and enhancement of natural capital which can benefit biodiversity and climate adaptation. This includes ecosystem-based solutions to challenges related to land, soil, forestry, agriculture, water and waste. The pilot phase of the NCFF project will last 3 years (2014-2017) with up to EUR 125 million being made available for investments in 9-12 operations….. The NCFF will employ a range of different financing options for different projects, including debt and equity financing as well as direct and intermediated funding.”

EU unlocking private Capital

Equity and fund investments We stimulate and catalyse private capital through investment in equity and funds. We work with new and established fund managers in traditional and innovative segments that are not yet mainstream.

European Energy Efficiency Fund (EEE F)

This €265 million fund is a “public-private partnership open to investments from institutional investors, professional investors and other well informed investors within the meaning of the Luxembourg SIF law. In particular targeted investors are donor agencies, governments, international financial institutions, and professional private investors.”

It “provides tailor-made debt and equity instruments to local, regional and (if justified) national public authorities or public or private entities acting on their behalf….”

Private Financing for Energy Efficiency instrument (PF4EE)

This is a new financial instrument under the EU’s LIFE programme (a funding instrument for the environment and climate action) which co-funds energy efficiency programmes in several EU countries.

EU advice services to raise capital

Energy Efficiency Financial Institutions Group (EEFIG) The EEFIG was set up by the European Commission and the United Nations Environment Programme Finance Initiative (UNEP FI) in 2013. It aims to engage with financial institutions to address the challenges in accessing long-term financing for energy efficiency.

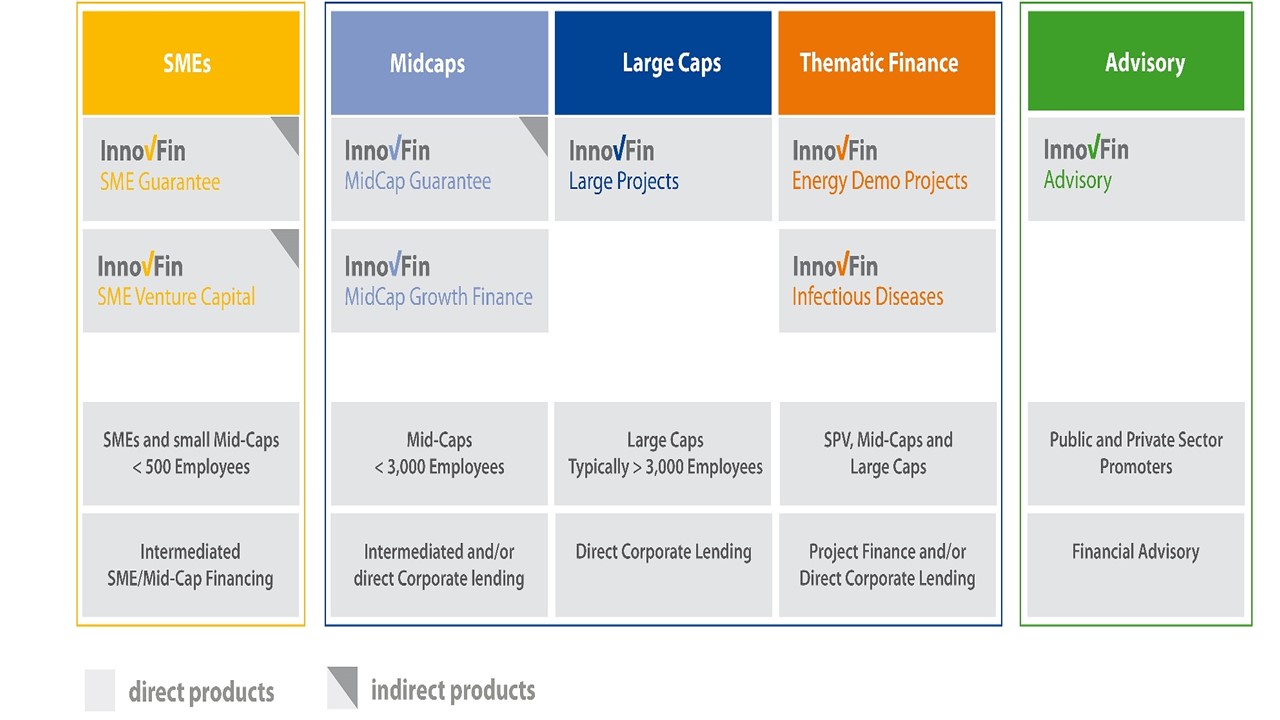

InnovFin Advisory guides its clients on how to structure their R&I projects in order to improve their access to finance. InnovFin is part of the InnovFin Programme and was set up “assist eligible public and private counterparts to improve the bankability and investment-readiness of large, complex, innovative projects that need substantial long-term investments.”

source: InnovFin Advisory

Although the ‘Higher Ambition’ to reduce future global warming to 1.5°C is staggering, activities from Governments and entrepreneurs to intensify investment and research is hopeful.

The scale and complexity of EU support for Innovation and funding to bring these to fruition is surprising and is a vital part of the global efforts to combat Climate Change.